Jopi Hendrayani suddenly raised his voice when talking about companies that increased cigarette excise. He was furious with the old bluffing trick that the companies use to put pressure on tobacco farmers.

The farmer who was born 48 years ago in Beleka Village, East Praya, Central Lombok, said that cigarette companies often use cigarette excise increase as an excuse to lower the purchase price of tobacco.

According to Jopi, almost every day, agents from the companies go to the fields to tell farmers about this. “Companies often raise the issue of increasing excise taxes. Consequently, the selling price of tobacco for the farmers will slump,” Jopi said in a phone interview with Jaring.id on Tuesday, August 24, 2021.

In fact, he said, the increase in excise duty should not have affected the price of tobacco that the company purchased from the farmers. Referring to data from the Central Lombok Agriculture Office, the tobacco absorption quota provided by the company in 2021 is 17,328 tons. Meanwhile, the area of land planted with tobacco is 8,264 hectares with a total production of 15,863 tons. “No matter how high the increase in excise duty is, it will not affect farmers,” Jopi said with a high voice.

So far, the main problem in the tobacco trade system is the price arrangement that is monopolized by the company. In front of cigarette companies, said Jopi, farmers have no bargaining power. “If we don’t sell, we can lose, but we try to sell it anyway, although we will lose. We have no choice. It’s still better to sell at loss rather than not earning money at all. We don’t have the power to raise prices,” he said.

Voicing similar views with Jopi, a tobacco farmer from Temanggung, Ihyaudin (40) perceived that the increase in cigarette excise was not the only reason that hit farmers’ tobacco purchase prices. “The weakness of tobacco farmers is that they cannot bargain the price. That way, companies using excise duty as a basis to put pressure on farmer that cannot have bargaining value,” said Udin to Jaring.id on a telephone interview, on Monday, August 23, 2021.

For this year, the price of tobacco grades A, B, to C is only priced at IDR 20,000 to IDR 40,000 per kilogram. In fact, last year, the price could be doubled. “The selling price is still going down. If it continues to decline until it cannot cover production costs, farmers will not earn anything,” he said.

Baca juga: Agar Rokok Tak Lagi Murah

In addition to the fact that farmers cannot control the price of tobacco, tobacco imports are also considered as another reason that hits the purchasing price of tobacco. This is exacerbated by the tobacco-mixing practice of tobacco graders—-the people who are in charge of assessing the quality of tobacco. He suspected that the graders mixed tobacco from Temanggung with the variant of tobacco from other regions, such as East Java and West Java. This mixing resulted in the tobacco harvest of Temanggung farmers not being absorbed optimally. “The quota becomes overloaded. The absorption capacity of tobacco from farmers is reduced. As a result, the selling price to farmers decreased further,” said Udin.

Meanwhile, Chairman of the Farmers Group of Tlahap Village, Temanggung, Central Java, Yamidi revealed that farmers are often become the victims in the tobacco trade system. Instead of cutting the wages of cigarette factory workers, the company prefers to lower the purchase price and quota of tobacco for farmers when they are in difficult conditions. This is because the company does not want to violate the provisions related to the wages of cigarette factory workers that have been set by the government through the regional minimum wage scheme. “Therefore, they think that the only way is to reduce the purchase of raw materials or tobacco from farmer,” Yamidi told Jaring.id by telephone on Monday, August 23, 2021.

The Central Statistics Agency (BPS) Temanggung noted that in 2018, tobacco production reached 13,356 tons. Meanwhile, in 2019 it fell to 12,764 tons. This year, according to Yamidi, the quota provided by PT Gudang Garam Tbk is 8500 tons. Other companies, including PT Djarum, provide 4500 tons, PT Nojorono Tobacco International provides 3000 tons and PT Jambu Bol sets its quota at 1500 tons.

Baca juga: Gertak Lama Setelah Cukai Rokok Naik

To make all harvests of tobacco harvests being purchased, Yamidi urged the government to immediately control the importation of raw materials by cigarette companies. BPS data shows that tobacco imports in 2019 reached 110.92 tons per year.

“The government should reduce it as much as possible. If it used to be 60 percent, it should only be 25 percent,” said Yamidi. He also asked the government not only to increase tobacco excise, but also import excise to 15 percent. “The entry tax should be raised. Currently, the excise duty on tobacco is very, very cheap compared to other countries,” said Yamidi.

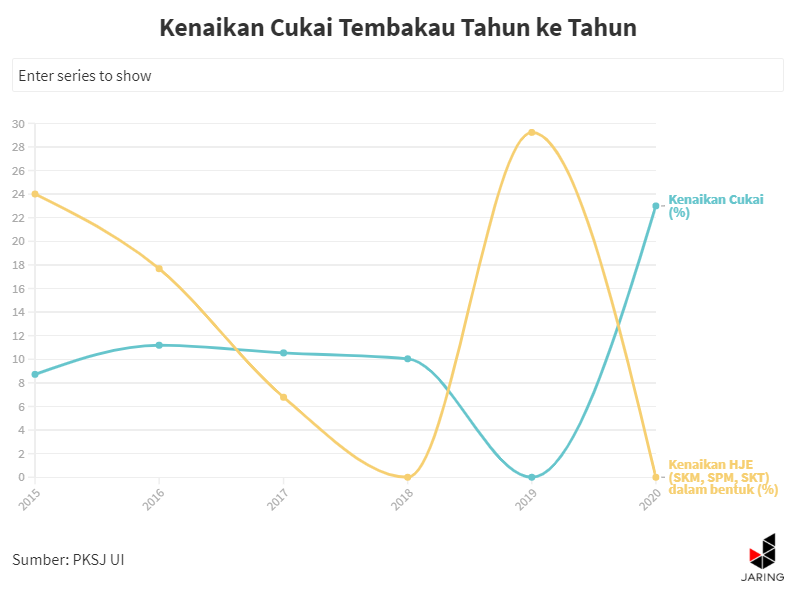

Previously, the Minister of Finance, Sri Mulyani Indrawati, announced that an average increase of tobacco product excise (CHT) was 12.5 percent in 2021. Thus, the target for cigarette excise tax revenues in the 2022 State Revenue and Expenditure Budget Draft (RAPBN) is IDR 203.92 billion or increased by 11 percent from the outlook in 2021.

The government realizes that the decision will trigger the circulation of illegal cigarettes by 4.9 percent. However, the government claims to have prepared some actions to mitigate the illegal cigarette circulation. “Indeed, there is an increase in the target,” said Sri Mulyani at a press conference on the Financial Note and the 2022 State Budget Bill, Monday, August 16, 2021.

Meanwhile, the Director of Technical and Excise Facilities at the Directorate General of Customs and Excise (DJBC) of the Ministry of Finance, Nirwala Dwi Heryanto, explained the reason for the delay in the announcement of the amount of the excise increase. The new excise tariff will be announced after the 2022 APBN is passed in the House of Representatives. “We will see how much the excise rate should be increased. It will be announced not too long after the law is issued, because there is a target for import duties on export duties,” said Nirwala in a virtual media briefing in Jakarta, Thursday, August 26, 2021.

The government, said Nirwala, plans to announce the new excise tariff in October 2021. He warned that tobacco companies would not harm farmers for the next two months. “In October, the new excise tariff will have started to take effect. So, it is easier for companies to do forecasting for 2022 and the preparation of excise bands is neatly arranged,” he said.

A number of cigarette industries that are members of the Association of Indonesian Cigarette Manufacturers (GAPPRI) have protested the government’s plan to increase excise taxes. GAPPRI even conveyed this objection by sending a letter to President Joko Widodo. According to the Chairman of GAPPRI, Henry Najoan, the increase in excise duty in the midst of the Covid-19 pandemic has put a lot of burden on the tobacco products industry (IHT).

“GAPPRI is committed to retaining the workforce. We are also maintaining state revenues from taxes and excise of around Rp 200 trillion. This is our real contribution to responding to the pandemic,” Henry said in a written statement, on Thursday, August 19, 2021.

Baca juga: Jakarta should restrict cigarette distribution zone

In 2020, sales of machine-made kretek cigarettes (SKM) fell by around 17.4 percent. Meanwhile, in the second quarter of 2021, the downward trend in SKM production still occurred in the negative 7.5 percent range compared to last year. This condition, said Hendry, will have an impact not only on producers but also on farmers. “Therefore, if the results decline, their income will automatically lower as well. And if this issue can’t be addressed, they can lose their jobs,” he said.

“We hope that the government will maintain the continuity of the national tobacco product industry as a form of the country’s self-sufficiency like these countries,” added Henry.

Meanwhile, the Indonesian Tobacco Farmers Association (APTI), Hananto Wibisono, reminded the government of the potential for illegal cigarettes. If that happens, then all parties will be harmed. The increase is considered to have a major impact on tens of thousands of tobacco farmers and cigarette workers. “The workers, as well as tobacco and clove farmers. The government will also be harmed because illegal cigarettes do not pay excise duty,” said Hananto in a written statement, Thursday, August 26, 2021.

The chairman of the National Tobacco Control Commission, Hasbullah Thabrany, has doubts about the company’s claims. According to him, the impact of the increase in cigarette excise tax is not related to the decrease in workers. “There is no evidence that the increase in cigarette excise has caused a decrease in workers. Companies use machines a lot. This is merely a bluff from the industry,” he told Jaring.id, on Tuesday, August 24, 2021. “That’s an empty response, there are no facts and evidence. I hope the government would not be affected,” he added.

Hasbullah said he supported the government’s decision to increase excise duty in 2021. He hopes the excise increase can be more than 12 percent. “We want to increase at least three times higher than inflation, because the effects of inflation, income, excise, must be able to produce a decrease in consumption,” said Thabrani.

He hoped that the government would be brave to increase excise duty above 60 percent in accordance with the maximum limit submitted by the World Health Organization (WHO). Based on Law Number 39 of 2007 concerning Amendments to Law Number 11 of 1995, it only limits the excise duty on tobacco products by 57 percent. According to him, the regulation has not been able to reduce cigarette consumption. “So, we have to raise the maximum limit again. In Australia and Singapore, the excise taxes can be above 80 percent,” he said.

Baca juga: The protracted revision of tobacco control regulation

Abdillah also suggested that the government levy a higher excise tax on the large cigarette industry and the machine cigarette industry. This is because the industry absorbs large amounts of tobacco. This scheme, according to him, cannot only protect the sustainability of producers, but also cigarette workers and tobacco and clove farmers. “For cigarettes produced from large manufacturing machine, it should be raised as high as possible,” he concluded.